Why are gas prices at the pump not directly correlated to crude oil prices?

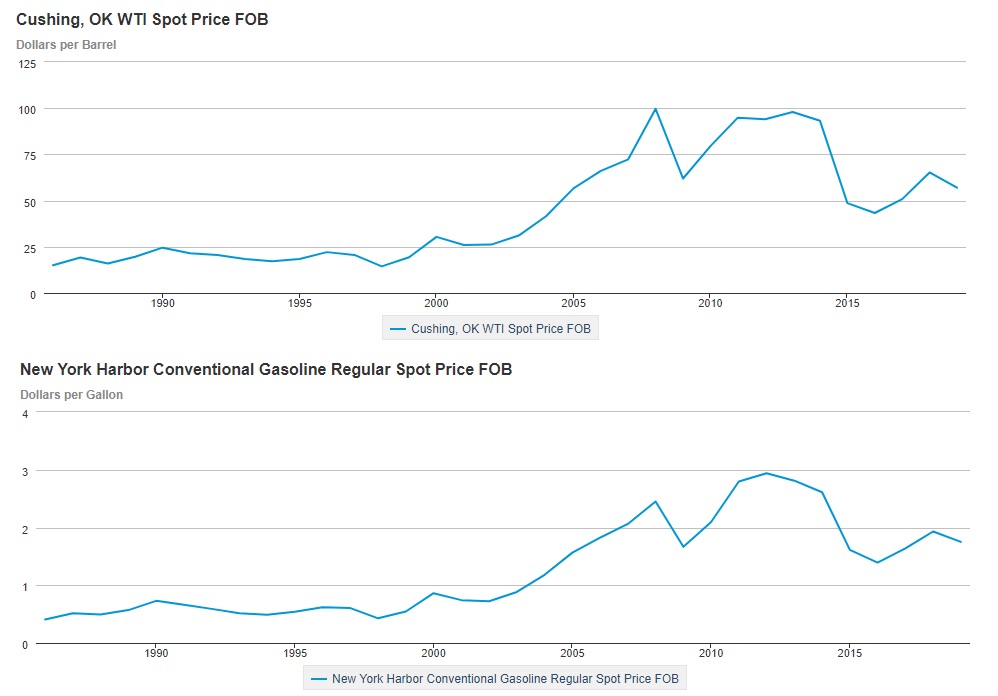

While the overall trend in the graphs seems correlated, the contrast lies in the details. If you look closely, the disparities will stand out. You will notice that the prices are not bound only to supply, demand, and the price of crude oil. Crude does not entirely affect the price at the pump most of the time. Below are a few factors that interfere with that relation:

Commodity Trading: In the stock market, you have people that trade futures for commodities like oil, gold, and sugar. These future stock traders buy contracts from the commodity seller for the price that they anticipate the commodity will sell for in the future. When traders do that, they are moving the price for the gas in directions, sometimes utterly unrelated to the market oil price, because they are creating a price bubble based on pure speculations.

Taxes, Tariffs, and sanctions: While the price of oil might be low, imposing a tariff on a specific country can cause a price jump for the importing country consumers, although the oil price might be low worldwide. Another example of high prices for gas at the pump that doesn’t relate to the oil spot price can be specific taxed locations. As of July 2019, California, for example, charges $0.55 per gallon as a gas tax and an additional 23.7 percent sales tax, while Mississippi charged a $0.18 gas tax per gallon and a 9.8 percent sales tax (Stebbins, 2019). Sanctions are also another example of affecting prices at the pump. At the same time, the United States imposed sanctions on Iranian oil in 2018-2019 did not benefit the USA on the pump, the European Union benefited greatly from the U.S. sanctions by buying cheap oil from Iran.

Scarcity and Abundance: When it comes to the Oil price, there are additional factors to take into consideration. Oil price reached an all-time high of $165.20 in 2008, world oil reserves were increased year over year but would not reflect the price of $20.19 an all-time low in 2020 (Bloomberg, 2020). Since the reserves did not increase significantly and the demand is higher because the world population is increasing every year, add to that the increase in appetite for the developing nations for oil consumption due to economic expansion and growth (U.S. Energy Information Administration, 2020). The question becomes, how do abundancy and scarcity come into play in the oil situation? Since the amount of oil we have on the planet is not increasing and we don’t have discoveries of new oil fields, we conclude that the scarcity of a commodity such as oil is dependent on the other factors. Factors like politics, wars, and production come into play; therefore, in this situation, oil is abundant but can be scarce depending on several factors (Macrotrends, n.d.).

Government Regulations: Take a regulation like tax breaks for electric vehicles. This regulation can help ease the consumption of gas at the pump. This government regulation can interfere with the price of the gas relative to the price of crude oil.

Gas Additives: In the USA, gas additives can severely affect the price of gas. The number of additives can hide the initial cost of oil. For example, ethanol additives account for about 10-15% of the gas price in the U.S. (U.S. Energy Information Administration, 2019). Although this additive is incredibly cheap in the USA because it is extracted from corn, a local produce, it can be expensive somewhere else.

Currency Valuation: While oil prices might drop, a country that has shaky finances with its national currency can have its citizens end up paying more for gas at the pump, especially if the country is an oil importer (Farley, 2019).

Refining costs, retail markup, and transportation expenses: If you take Alaska as an example, While Alaska has the lowest gas tax price, the lowest sales tax across the USA, it has the 4th highest gas price. This is due to the fact that Alaska is so remote and has limited refineries (Minemyer, 2018). The increased need for transport in remote and harsh conditions makes the retail markup high compared to other states (Minemyer, 2018).

As we can notice, several factors affect the price of gas from the time it is crude oil to the time it reaches the pump. Economic, social, technological, and trade factors all come into play to regulate the price of this commodity that has made some countries flourish, and others get torn apart.

Reference

Stebbins, S. (2019, February 5). How much gas tax adds to cost of filling up your car in every state. Retrieved April 20, 2020, from https://www.usatoday.com/story/money/2019/02/05/gas-tax-state-what-costs-fill-up-your-car-across-country/38908491/

Minemyer, D. (2018, December 30). Why gas prices are so high in the Last Frontier. Retrieved April 19, 2020, from https://www.ktuu.com/content/news/Remembering-why-gas-prices-are-so-high-in-the-Last-Frontier-503690871.html

Bloomberg. (n.d.). Crude Oil & Natural Gas Prices. Retrieved April 13, 2020, from https://www.bloomberg.com/energy

U.S. Energy Information Administration. (n.d.). World Crude Oil Reserves by Year. Retrieved April 13, 2020, from https://www.indexmundi.com/energy/?product=oil&graph=reserves

Macrotrends. (n.d.). Crude Oil Prices – 70 Year Historical Chart. Retrieved April 13, 2020, from https://www.macrotrends.net/1369/crude-oil-price-history-chart

U.S. Energy Information Administration – EIA – Independent Statistics and Analysis. (2019, May 14). Retrieved April 20, 2020, from https://www.eia.gov/tools/faqs/faq.php?id=27&t=4

Farley, A. (2019, August 12). Understanding the Correlation of Oil and Currency. Retrieved April 20, 2020, from https://www.investopedia.com/articles/forex/092415/oil-currencies-understanding-their-correlation.asp

Comments are closed.